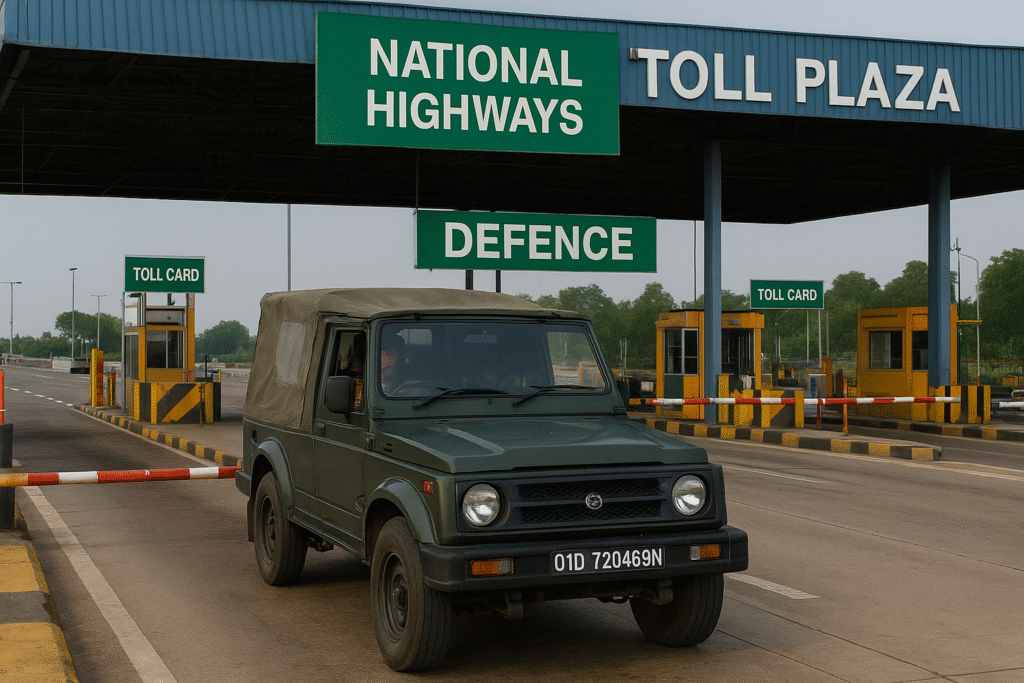

For every Fauji, daily travel to and from the unit or workplace is non-negotiable. Whether you’re commuting in your car, riding your bike, or managing family vehicles, fuel is one of the biggest recurring monthly expenses.

On average, a Fauji family spends anywhere between ₹5,000–₹10,000 per month on fuel (sometimes even more if multiple vehicles are in use). Over a year, that’s ₹60,000–₹1,20,000 just on petrol or diesel.

Now imagine getting a straight 7.5% value back on every litre of fuel you pump—that’s exactly what the BPCL SBI Card Octane gives you. Designed specifically as a fuel-saver credit card, this card ensures that your mandatory monthly travel expense turns into guaranteed savings.

Fuel Benefits – Where the Real Value Lies

The highlight of the BPCL SBI Card Octane is its 7.5% value back on fuel purchases at BPCL (Bharat Petroleum) outlets across India.

👉 Let’s break it down with an example:

- Suppose a Fauji spends ₹8,000/month on fuel.

- With 7.5% value back, you save ₹600/month.

- In a year, that’s ₹7,200 saved directly.

And remember—most other credit cards don’t even give any rewards on fuel spends. This makes BPCL SBI Octane a one-of-its-kind, must-have card for soldiers and their families.

Add-On Card Facility – Covering the Whole Family

Faujis aren’t the only ones refueling—your spouse or children may also use vehicles daily. The BPCL SBI Card Octane allows you to issue add-on cards for family members.

- All fuel expenses—yours and your family’s—will reflect in one consolidated monthly bill.

- No hassle of managing multiple accounts or payments.

- Easy to track family fuel spending in one place.

This feature makes it super convenient for Fauji families to maximize savings without extra effort.

Other Key Perks & Features

While fuel savings are the main attraction, the BPCL SBI Card Octane comes with a bunch of lifestyle and shopping benefits too:

- ✈️ Complimentary lounge access at select domestic airports.

- 🎯 Milestone benefits for higher spends across categories.

- 💸 Renewal fee waiver on reaching specific annual expenditure.

- 🛒 Amazon sale offers: During SBI-exclusive sales on Amazon, you get 10% instant discount, saving more on gadgets, clothing, and household needs.

Annual Fee & Waiver

- The annual/renewal fee is ₹1,499 + GST.

- However, if your yearly spends cross ₹2,00,000, the renewal fee is completely waived.

👉 For an average Fauji family spending ₹8,000 on fuel + other daily expenses, reaching this threshold is very realistic. In fact, many will automatically qualify for the waiver without even trying.

Referral Bonus – Extra Gift for You 🎁

Here’s the best part:

👉 Apply through the FaujiTips referral link and use referral code to get a ₹500 voucher instantly after card activation.

⚠️ Important: You won’t get this ₹500 benefit if you apply directly on the SBI website.

So don’t miss out on this extra joining perk—it’s our small gift to you.

Why It’s Perfect for Faujis

✔️ Direct savings on unavoidable fuel expenses.

✔️ Family add-on cards cover everyone’s refueling needs.

✔️ Lounge access for frequent travellers—great for TDs, postings, or personal trips.

✔️ Amazon discounts and milestone benefits add even more value.

Honestly, if you don’t already own a dedicated fuel card, the BPCL SBI Card Octane is a no-brainer.

Conclusion

Fuel expenses are non-negotiable for every Fauji, but that doesn’t mean you can’t save smartly. The BPCL SBI Card Octane helps you convert those mandatory spends into significant savings while also offering travel and shopping perks.

💬 Do share your thoughts in the comments below. Have you tried any other fuel card? Or do you think this is the best option for Faujis? We’ll love to hear from you.

Final CTA

👉 Apply Now using my Referral Link

Referral Code: jhjmOaajD1N

🎁 Reminder: Get a ₹500 voucher instantly after card activation if you apply through this referral link. Don’t miss out!